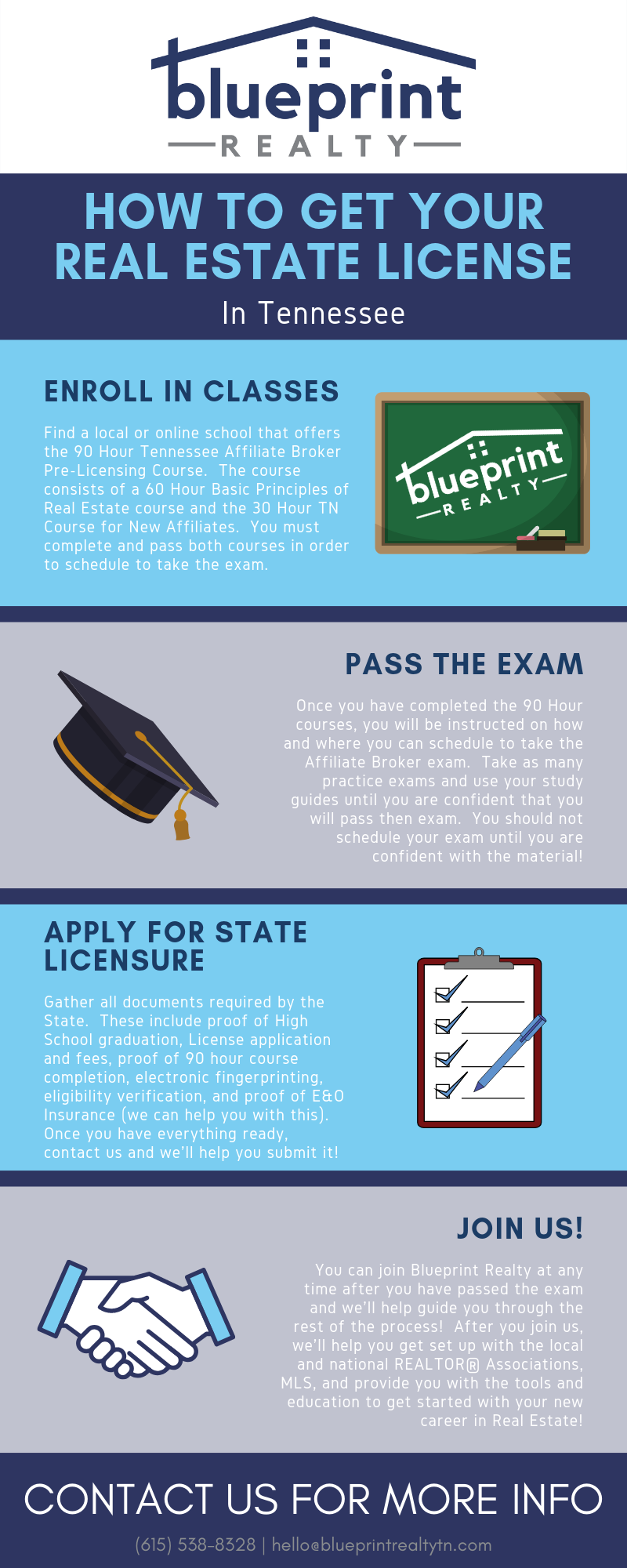

There are many things that you should consider if you wish to become licensed in California as a real estate agent. At least 18 years of age and a clean criminal record are required. Also, your application must include fingerprinting.

A real estate license in California is not cheap. The cost of the actual license can range from around $800 to $1,300. There are several options to lower the cost. You can get a broker’s license to lower the cost to below $600

A pre-licensing class is another way to reduce the cost of getting your licence. This could be a college-level course, or a class at an accredited private institution. In general, a pre-licensing program will cost between $125 and $700. Some providers offer test preparation tools such as digital flashcards for the exam.

Also, you will need to pass the required tests. The exam contains 150 multiple-choice and can take approximately three hours. Each question will take you one minute to answer. You can pass the realty exam on your first try. It is possible to pass the real estate exam on your first attempt. However, most people will need to repeat it several times before they feel comfortable with the task.

Studying is the best way to pass the DRE real-estate exam. Two schools offer the education in California. Check with the California Department of Real Estate before you make any decisions about whether your school is accredited.

Don't forget to sign-up for the Multiple Listing Service, while you're studying for the DRE. This database is the biggest used by real estate agents. It is a great tool to help you find leads and promote the business. Once you're a member, you can post your listings to the MLS.

To get your license, you will need to pay several fees. They will vary depending upon where you live. California charges $60 for a $60 non-refundable application fee. This includes the exam cost. Candidates can pay the exam fee by sending a check or money order.

You will need to renew your real estate license every four years once you have it. By submitting an updated form, you can renew your license. After that, you will have to pay $245 for the renewal fee. You will also need to complete 45 hours worth of continuing education. These courses may include topics such as trust fund handling, fair housing, risk management and fair housing.

Finally, you will have to take a final exam. The eLicensing platform makes it easy to schedule exams and allows you to do so at your own convenience. Alternatively, you can choose to have the exam at a location of your choice. You should arrive at least 30 minutes prior to the exam start.

FAQ

Can I buy a house in my own money?

Yes! Yes. These programs include FHA, VA loans or USDA loans as well conventional mortgages. For more information, visit our website.

Should I use a broker to help me with my mortgage?

If you are looking for a competitive rate, consider using a mortgage broker. A broker works with multiple lenders to negotiate your behalf. Some brokers receive a commission from lenders. Before signing up for any broker, it is important to verify the fees.

What is the maximum number of times I can refinance my mortgage?

This is dependent on whether the mortgage broker or another lender you use to refinance. You can refinance in either of these cases once every five-year.

Should I buy or rent a condo in the city?

Renting is a great option if you are only planning to live in your condo for a short time. Renting allows you to avoid paying maintenance fees and other monthly charges. The condo you buy gives you the right to use the unit. You have the freedom to use the space however you like.

Can I get a second loan?

Yes. However, it's best to speak with a professional before you decide whether to apply for one. A second mortgage is often used to consolidate existing loans or to finance home improvement projects.

How can I get rid of termites & other pests?

Termites and other pests will eat away at your home over time. They can cause serious destruction to wooden structures like decks and furniture. To prevent this from happening, make sure to hire a professional pest control company to inspect your home regularly.

What should I look for in a mortgage broker?

A mortgage broker helps people who don't qualify for traditional mortgages. They look through different lenders to find the best deal. Some brokers charge fees for this service. Others offer free services.

Statistics

- This means that all of your housing-related expenses each month do not exceed 43% of your monthly income. (fortunebuilders.com)

- 10 years ago, homeownership was nearly 70%. (fortunebuilders.com)

- It's possible to get approved for an FHA loan with a credit score as low as 580 and a down payment of 3.5% or a credit score as low as 500 and a 10% down payment.5 Specialty mortgage loans are loans that don't fit into the conventional or FHA loan categories. (investopedia.com)

- Private mortgage insurance may be required for conventional loans when the borrower puts less than 20% down.4 FHA loans are mortgage loans issued by private lenders and backed by the federal government. (investopedia.com)

- Some experts hypothesize that rates will hit five percent by the second half of 2018, but there has been no official confirmation one way or the other. (fortunebuilders.com)

External Links

How To

How to find an apartment?

Moving to a new place is only the beginning. This takes planning and research. It includes finding the right neighborhood, researching neighborhoods, reading reviews, and making phone calls. While there are many options, some methods are easier than others. Before renting an apartment, you should consider the following steps.

-

Data can be collected offline or online for research into neighborhoods. Websites such as Yelp. Zillow. Trulia.com and Realtor.com are some examples of online resources. Offline sources include local newspapers, real estate agents, landlords, friends, neighbors, and social media.

-

Read reviews of the area you want to live in. Yelp. TripAdvisor. Amazon.com all have detailed reviews on houses and apartments. You can also check out the local library and read articles in local newspapers.

-

To get more information on the area, call people who have lived in it. Ask them about their experiences with the area. Also, ask if anyone has any recommendations for good places to live.

-

Take into account the rent prices in areas you are interested in. If you think you'll spend most of your money on food, consider renting somewhere cheaper. On the other hand, if you plan on spending a lot of money on entertainment, consider living in a more expensive location.

-

Learn more about the apartment community you are interested in. Is it large? How much is it worth? Is it pet-friendly? What amenities is it equipped with? Do you need parking, or can you park nearby? Are there any rules for tenants?