Appraisals are a key part of the home-buying process, especially when you're dealing with a lender. As a condition to closing the loan, you will be required in most cases to pay for an appraiser.

The value a property has is important in determining your mortgage and the price that you'll be paying for it. A property appraiser can estimate the value by looking at several factors including the size and location of the property as well as any improvements made by the owner. They will also look at recent sales prices for similar properties in your area.

What Can Go Wrong With An Appraisal

A bad appraisal can make the home buying process a difficult one. This could stall the transaction or cause a complete stop to a sale. It is possible to increase the likelihood that an appraiser will provide a reasonable and accurate appraisal.

How to increase the value of your house

Improve your home’s appearance to boost its appraised value. It's important to fix up cosmetic problems, improve curb appeal and make sure that the lawn is well-mowed.

Repairing your roof, sidings, gutters, and plumbing is also a great idea. If you fix structural problems, your house will be better and more valuable.

It is also possible to increase the value of your property by repairing your landscape and installing new fencing. These small improvements will help buyers understand the value and competitiveness of your home.

You Can Change The Age of Your Home

The age of the home also plays a role in its value. Older homes have better maintenance than newer constructions and are usually located in historic areas. The age and location of a house can affect the amenities in a neighborhood.

Using the Gross Income Multiplier or Cost Approach to Value Investment Properties

Appraisers can use different approaches to value a property they are considering for rental. They can, for example, use comparable sales or rental data to estimate what a property is worth and multiply that by the expected rental income.

Alternatively, they can calculate the value of a property using its total investment potential (the sum of all money it could earn). In this case they will use a net-income multiplier, and subtract the depreciation from the value of the property.

If you feel the appraiser left out important features or characteristics about your home in their analysis or omitted certain comparable homes, you can request an appraisal rebuttal. This process doesn't work every time, but it's still worth trying if you believe it will lead to a more accurate valuation of your house.

Home appraisals can be challenging, but they are important to maximize. A good appraisal will help you negotiate with your bank and determine whether you can afford to buy the house. It's important to check the appraisal report before you sign any contract if you are concerned about it.

FAQ

How much money do I need to purchase my home?

It depends on many factors such as the condition of the home and how long it has been on the marketplace. Zillow.com shows that the average home sells for $203,000 in the US. This

Should I rent or buy a condominium?

Renting could be a good choice if you intend to rent your condo for a shorter period. Renting allows you to avoid paying maintenance fees and other monthly charges. However, purchasing a condo grants you ownership rights to the unit. You can use the space as you see fit.

How long does it usually take to get your mortgage approved?

It is dependent on many factors, such as your credit score and income level. It typically takes 30 days for a mortgage to be approved.

How long does it take for my house to be sold?

It depends on many factors, such as the state of your home, how many similar homes are being sold, how much demand there is for your particular area, local housing market conditions and more. It can take from 7 days up to 90 days depending on these variables.

Can I get a second mortgage?

However, it is advisable to seek professional advice before deciding whether to get one. A second mortgage is often used to consolidate existing loans or to finance home improvement projects.

Statistics

- This seems to be a more popular trend as the U.S. Census Bureau reports the homeownership rate was around 65% last year. (fortunebuilders.com)

- Based on your credit scores and other financial details, your lender offers you a 3.5% interest rate on loan. (investopedia.com)

- This means that all of your housing-related expenses each month do not exceed 43% of your monthly income. (fortunebuilders.com)

- 10 years ago, homeownership was nearly 70%. (fortunebuilders.com)

- It's possible to get approved for an FHA loan with a credit score as low as 580 and a down payment of 3.5% or a credit score as low as 500 and a 10% down payment.5 Specialty mortgage loans are loans that don't fit into the conventional or FHA loan categories. (investopedia.com)

External Links

How To

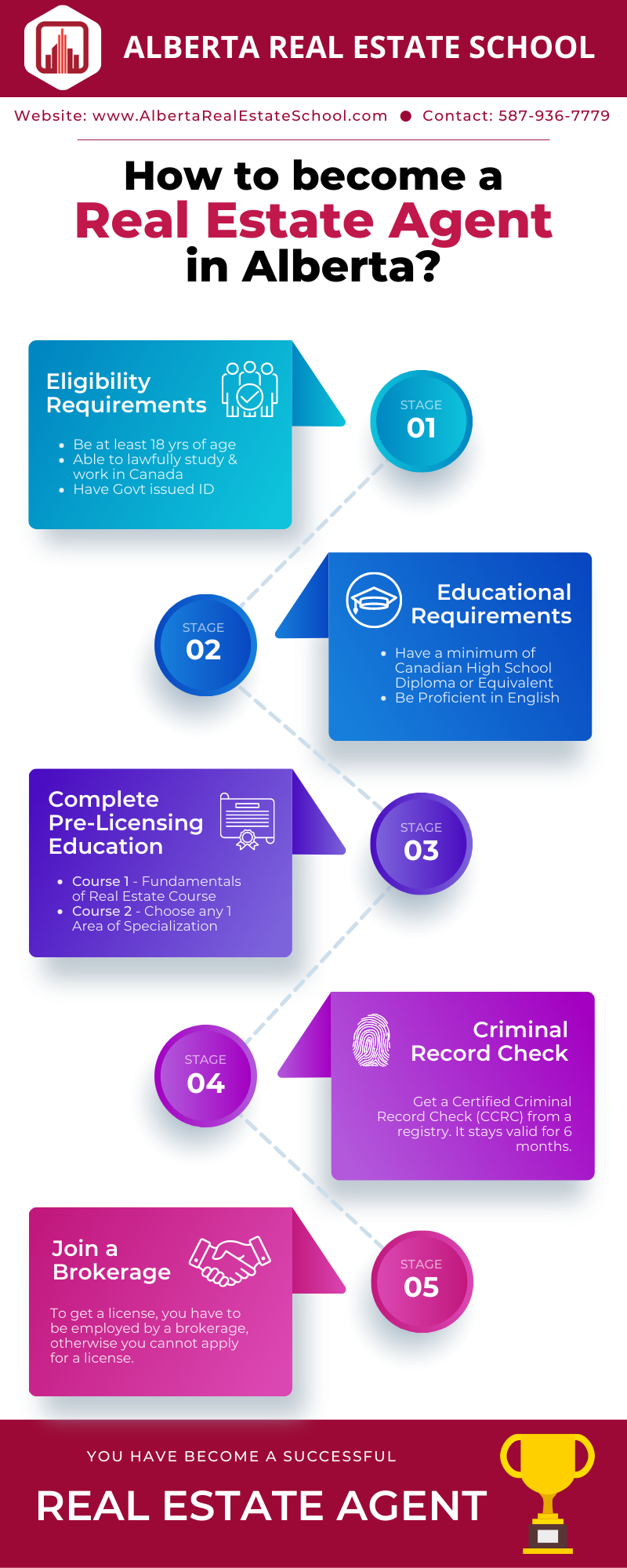

How to become an agent in real estate

An introductory course is the first step towards becoming a professional real estate agent. This will teach you everything you need to know about the industry.

The next step is to pass a qualifying examination that tests your knowledge. This requires that you study for at most 2 hours per days over 3 months.

This is the last step before you can take your final exam. To be a licensed real estate agent, you must achieve a minimum score of 80%.

Once you have passed these tests, you are qualified to become a real estate agent.