The real estate commission model has been a popular choice over the years and is still a viable option. In 2009, the average fee charged for representing a buyer or seller was $13,990. The traditional real estate model is still strong despite the emergence of many new companies during the real estate boom between 2005 and 2007. In the Great Recession buyers were more willing than ever to pay listing agents. The downturn forced many agents to leave the company.

Realogy's 2009 average home sale price of $390,688 was

Realogy's data indicates that in 2009, the average home was sold for $390 688. Comparatively, the average home sold for $553,000.081 in 2010. In both years, the average home sale price has increased steadily. In recent years the company has witnessed a steady decline of commission rates. This trend was temporarily reversed during the Great Recession. Consumers were willing to pay more commission rates. But, the increase in home price has outweighed the drop in commission rates.

However, home sales decreased slightly in 2009. The number of homes sold in 2009 was 4% lower than 2008, The median sale price dropped 5% from 2008. This drop was largely attributable to fewer REO sales and more distressed sales.

Glass House Real Estate rebates are part of the buyer's commission

Glass House Real Estate is an all-service brokerage that offers real estate services. They offer a rebate to buyers for a part of the agent's fees. With their unique rebate program, homebuyers can cut down on real estate transaction costs by 2%. Additionally, they offer a 50% discount on the commission of your listing agent. Glass House has offered over $1,000,000 in rebates for its buyers since 2006. The website includes a rebate calculator, MLS search and a guide for first-time buyers.

Rebates are an excellent way for buyers to cut transaction costs and boost competition among NYC's real estate agents. Commission rebates can be given in the form of a check at the closing or as a credit toward the purchase price. Although rebates are generally not subject to tax, it is still a good idea consult a tax accountant first before accepting them.

Realogy's average fee of $13,990 for representing a buyer/seller increased to $13,990 during 2009.

Realogy's fee structure looks similar to that of other brokers. A portion of the commission is paid by the seller to the buyer's representative. Realogy also owns Century 21, Coldwell Banker and ERA. As of January 2019, the average fee to represent the seller or buyer was $13,990. This isn't the only thing to consider when choosing a agent.

Sellers are concerned about how long it takes to sell their home. RealSure aims to eliminate this concern. Home sellers won't have to wait for their home to sell for months. Realogy-affiliated agents are required to sign a listing agreement for home sellers. It does not include the lower-fee iBuyer option. Realogy has also made the program a lead generation tool.

Realogy's average commission to represent the seller is split among the listing agent, and what will go on the MLS for any agent

Realogy agents received an average commission of $10.519 to represent one person in a transaction. This number is projected to rise up to $553.081 in 2020. The average commission for representing the seller will be $13,990 in 2020. Realogy agents are charged an additional 2.48% commission.

While the commission rate may fluctuate depending on housing market conditions and other market factors, it doesn't change in proportion to home price. The average commission to represent a seller is less in a competitive market. However, the commission fee per transaction is still fairly flexible in comparison with home sales prices. Despite the fact, consumers have paid considerably higher rates for brokerage service in recent times.

FAQ

Is it possible sell a house quickly?

You may be able to sell your house quickly if you intend to move out of the current residence in the next few weeks. You should be aware of some things before you make this move. First, find a buyer for your house and then negotiate a contract. Second, prepare the house for sale. Third, it is important to market your property. Lastly, you must accept any offers you receive.

How much will it cost to replace windows

Replacement windows can cost anywhere from $1,500 to $3,000. The total cost of replacing all your windows is dependent on the type, size, and brand of windows that you choose.

Is it cheaper to rent than to buy?

Renting is usually cheaper than buying a house. It's important to remember that you will need to cover additional costs such as utilities, repairs, maintenance, and insurance. Buying a home has its advantages too. For instance, you will have more control over your living situation.

What are the chances of me getting a second mortgage.

Yes. However it is best to seek the advice of a professional to determine if you should apply. A second mortgage is used to consolidate or fund home improvements.

Are flood insurance necessary?

Flood Insurance protects against damage caused by flooding. Flood insurance helps protect your belongings and your mortgage payments. Find out more information on flood insurance.

Should I buy or rent a condo in the city?

Renting might be an option if your condo is only for a brief period. Renting can help you avoid monthly maintenance fees. On the other hand, buying a condo gives you ownership rights to the unit. You are free to make use of the space as you wish.

What are the most important aspects of buying a house?

The three most important things when buying any kind of home are size, price, or location. Location refers the area you desire to live. Price refers the amount that you are willing and able to pay for the property. Size refers the area you need.

Statistics

- This means that all of your housing-related expenses each month do not exceed 43% of your monthly income. (fortunebuilders.com)

- 10 years ago, homeownership was nearly 70%. (fortunebuilders.com)

- When it came to buying a home in 2015, experts predicted that mortgage rates would surpass five percent, yet interest rates remained below four percent. (fortunebuilders.com)

- It's possible to get approved for an FHA loan with a credit score as low as 580 and a down payment of 3.5% or a credit score as low as 500 and a 10% down payment.5 Specialty mortgage loans are loans that don't fit into the conventional or FHA loan categories. (investopedia.com)

- Some experts hypothesize that rates will hit five percent by the second half of 2018, but there has been no official confirmation one way or the other. (fortunebuilders.com)

External Links

How To

How to become a real estate broker

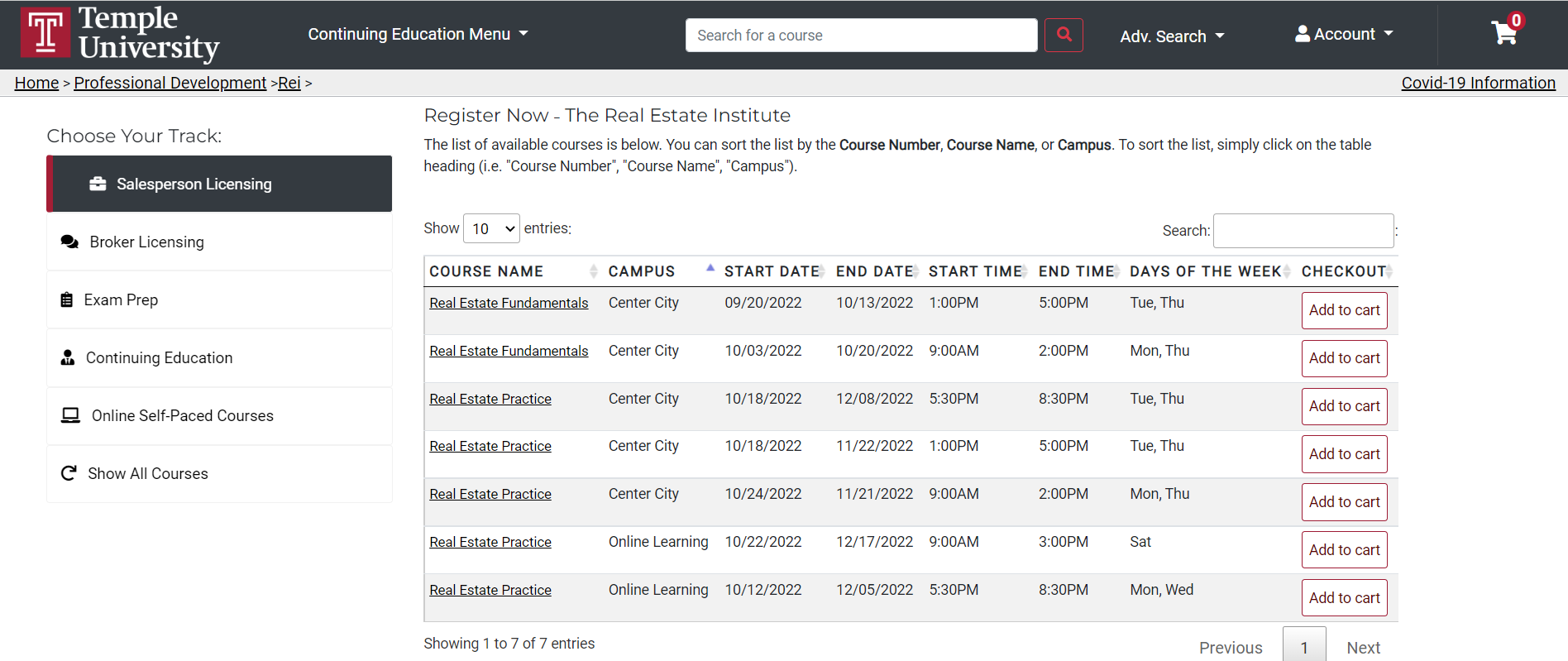

You must first take an introductory course to become a licensed real estate agent.

The next thing you need to do is pass a qualifying exam that tests your knowledge of the subject matter. This involves studying for at least 2 hours per day over a period of 3 months.

You are now ready to take your final exam. For you to be eligible as a real-estate agent, you need to score at least 80 percent.

If you pass all these exams, then you are now qualified to start working as a real estate agent!